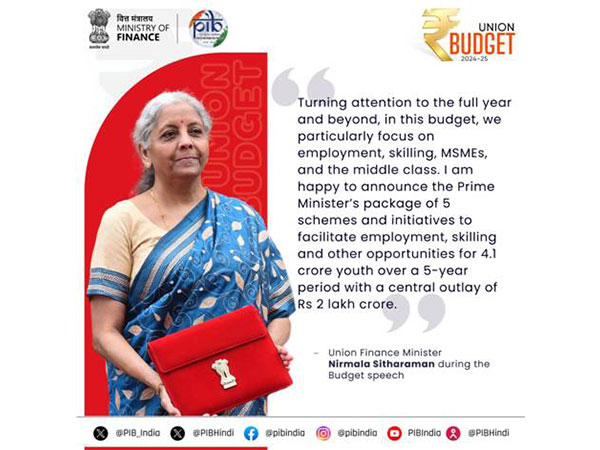

New Delhi [India], July 23 (ANI): Finance Minister Nirmala Sitharaman outlined a robust plan focusing on jobs, MSME, agriculture sector, startups, and economic growth amid global uncertainties while presenting Union Budget 2024-25 on Tuesday.

According to a press release by the Ministry of Finance, India’s inflation remains low and stable, progressing towards the 4 per cent target, with core inflation (excluding food and fuel) at 3.1 per cent. Measures are being taken to ensure adequate market supply of perishable goods.

Sitharaman emphasized the interim budget’s focus on four key groups: the poor (Garib), women (Mahilayen), youth (Yuva), and farmers (Annadata).

Sitharaman unveiled the Prime Minister’s package, which includes five schemes aimed at providing employment, skills, and opportunities for 41 million youth over the next five years, with a central allocation of Rs 2 lakh crore.

This year, Rs 1.48 lakh crore is earmarked for education, employment, and skill development.

For the ‘Viksit Bharat’ vision, the budget outlines nine priorities to foster opportunities for all: enhancing productivity and resilience in agriculture, creating employment and skill development opportunities, promoting inclusive human resource development and social justice, boosting manufacturing and services, advancing urban development, ensuring energy security, improving infrastructure, supporting innovation, research, and development and implementing next-generation reforms, stated the press release.

The budget will support farmers with the release of 109 high-yielding, climate-resilient crop varieties. Over the next two years, 10 million farmers will be introduced to natural farming, with support for certification and branding. Additionally, 10,000 bio-input resource centres will be established.

To achieve self-sufficiency in pulses and oilseeds, the government will enhance production, storage, and marketing, focusing on crops like mustard, groundnut, sesame, soybean, and sunflower.

The implementation of Digital Public Infrastructure (DPI) in agriculture will be facilitated to cover farmers and their lands within three years.

An allocation of Rs 1.52 lakh crore is set aside for agriculture and allied sectors this year.

The government will introduce three ‘Employment Linked Incentive’ schemes under the Prime Minister’s package, targeting EPFO enrolment, first-time employee recognition, and support for both employees and employers.

Over the next five years, 2 million youth will be skilled, and 1,000 Industrial Training Institutes will be upgraded. The Model Skill Loan Scheme will be revised to offer loans up to Rs 7.5 lakh with government-backed guarantees, benefiting 25,000 students annually.

Financial support for higher education loans up to Rs 10 lakh will be provided, with e-vouchers issued to 1 lakh students each year for a 3 per cent interest subvention.

The government will expand existing schemes like PM Vishwakarma, PM SVANidhi, National Livelihood Missions, and Stand-Up India.

A new plan, Purvodaya, will focus on the holistic development of eastern states, including Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

The Pradhan Mantri Janjatiya Unnat Gram Abhiyan will aim for comprehensive coverage of tribal families in 63,000 villages, benefiting 50 million tribal individuals.

India Post Payment Bank will establish over 100 branches in the Northeast, and Rs 2.66 lakh crore is allocated for rural development, including infrastructure.

A new self-financing guarantee fund will provide guarantee cover up to Rs 100 crore for applicants, while public sector banks will enhance their ability to assess MSMEs for credit internally, read the press release.

The Mudra loan limit will be increased to Rs 20 lakh for successful borrowers, and financial support will be provided for setting up 50 multi-product food irradiation units and 100 food quality and safety testing labs.

E-Commerce Export Hubs will be created to help MSMEs and traditional artisans access international markets.

Under PM Awas Yojana Urban 2.0, Rs 10 lakh crore will address the housing needs of 10 million urban poor and middle-class families, including central assistance of Rs 2.2 lakh crore over five years.

The Surya Ghar Muft Bijli Yojana will install rooftop solar panels to provide free electricity up to 300 units per month for 10 million households. The scheme has seen significant interest, with over 1.28 crore registrations and 14 lakh applications.

The government will maintain strong fiscal support for infrastructure while adhering to fiscal consolidation goals. This year’s capital expenditure is set at Rs 11.11 lakh crore, representing 3.4 per cent of GDP.

Financial support for irrigation and flood mitigation projects in Bihar, Assam, Himachal Pradesh, Uttarakhand, and Sikkim will be provided.

The Finance Minister announced the establishment of the Anusandhan National Research Fund for basic research and prototype development, with a Rs 1 lakh crore financing pool to stimulate private sector-driven research and innovation.

A venture capital fund of Rs 1,000 crore will be set up to expand the space economy.

For 2024-25, total receipts (excluding borrowings) are estimated at Rs 32.07 lakh crore, and total expenditure at Rs 48.21 lakh crore.

Net tax receipts are projected at Rs 25.83 lakh crore, with a fiscal deficit estimated at 4.9 per cent of GDP. Gross and net market borrowings are estimated at Rs 14.01 lakh crore and Rs 11.63 lakh crore, respectively.

Sitharaman highlighted that the fiscal consolidation strategy introduced in 2021 has been effective, with a goal to reduce the deficit below 4.5 per cent next year, read the press release.

In the Budget for 2024-25, the standard deduction for salaried employees opting for the new tax regime has been increased from Rs 50,000 to Rs 75,000.

Additionally, the deduction for family pensions has been raised from Rs 15,000 to Rs 25,000. These changes are intended to provide greater financial relief to these groups.

Furthermore, the rules regarding the reopening of tax assessments have been revised. Assessments can now be reopened up to five years from the end of the assessment year, but only if the escaped income exceeds Rs 50 lakh. This modification aims to streamline tax compliance and enforcement.

The new tax regime has also been updated to offer salaried employees potential savings of up to Rs 17,500 in income tax.

The revised tax rate structure is designed to provide clearer benefits across different income slabs.

According to the new structure, income up to Rs 3 lakh is tax-free, while income between Rs 3 lakh and Rs 7 lakh is taxed at 5 per cent.

Income ranging from Rs 7 lakh to Rs 10 lakh is taxed at 10 per cent, and income from Rs 10 lakh to Rs 12 lakh is taxed at 15 per cent.

For income between Rs 12 lakh and Rs 15 lakh, the tax rate is 20 per cent, and income above Rs 15 lakh is taxed at 30 per cent.

The Budget has boosted the entrepreneurial spirit and start-up ecosystem by abolishing angel tax for all types of investors.

It also proposes a simplified tax regime for foreign shipping companies involved in domestic cruises, recognizing the considerable potential of cruise tourism, read the press release.

Additionally, foreign mining companies selling raw diamonds in India can now benefit from safe harbour rates, which will positively impact the diamond industry.

The corporate tax rate for foreign companies has been reduced from 40 per cent to 35 per cent to attract more foreign investment. The Budget has also simplified the direct tax system for charities, revised the TDS rate structure, and reformed capital gains taxation.

The two existing tax exemption regimes for charities will be merged into a single regime. The TDS rate on many payments will be reduced from 5 per cent to 2 per cent, and the 20 per cent TDS on repurchases of units by mutual funds or UTI will be removed.

The TDS rate for e-commerce operators will be cut from 1 per cent to 0.1 per cent. Additionally, credits for TCS will now be applied to TDS deducted from salaries, and delays in TDS payments will no longer be criminalized if settled by the due date of the TDS statement.

Simplified and rationalized compounding guidelines for TDS defaults will be introduced soon.

For capital gains, short-term gains will now be taxed at 20 per cent on certain financial assets, while long-term gains on all financial and non-financial assets will be taxed at 12.5 per cent.

The exemption limit for capital gains has been increased to Rs 1.25 lakh per year to benefit lower and middle-income groups.

The Budget also proposes further digitization and paperless processing of Customs and Income Tax services over the next two years.

Custom duties have been revised to ease trade and reduce disputes.

Cancer patients will benefit from the full exemption of three additional cancer-treating medicines from customs duties: Trastuzumab Deruxtecan, Osimertinib, and Durvalumab.

The Basic Customs Duty (BCD) on X-ray machine tubes and flat panel detectors has been reduced, while BCD on mobile phones, Printed Circuit Board Assembly (PCBA), and mobile chargers is now 15 per cent.

To encourage the processing and refining of critical minerals, customs duties on 25 rare earth minerals like lithium have been fully exempted or reduced.

Exemptions are also proposed for capital goods used in solar panel manufacturing. To boost seafood exports, BCD on broodstock, polychaete worms, shrimps, and fish feed has been lowered to 5 per cent, read the press release.

The Budget aims to enhance the competitiveness of Indian leather and textiles by reducing BCD from 7.5 per cent to 5 per cent on Methylene Diphenyl Diisocyanate (MDI), used in spandex yarn production.

Custom duties on gold and silver have been reduced to 6 per cent and on platinum to 6.4 per cent. BCD on ferro nickel and blister copper has been removed, while BCD on ammonium nitrate has been increased from 7.5 per cent to 10 per cent to support new and existing capacities, read the press release.

The BCD on PVC flex banners has been increased from 10 per cent to 25 per cent due to environmental concerns.

To promote domestic manufacturing, BCD on PCBA for specific telecom equipment has been raised from 10 per cent to 15 per cent.

The Union Finance Minister introduced the Vivad se Vishwas Scheme, 2024 to address specific income tax disputes that are currently under appeal.

The financial thresholds for filing appeals involving direct taxes, excise, and service tax have been raised to Rs 60 lakh for High Courts, Rs 2 crore for the Supreme Court, and Rs 5 crore for tribunals. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages