NewsVoir

Mumbai (Maharashtra) [India], March 26: With the financial year FY 24-25, drawing a close, individuals and families still have a valuable window of opportunity to make smart, impactful decisions around their tax planning and financial security. With the March 31st deadline approaching, this period becomes a crucial checkpoint not just for filing paperwork, but for strategically aligning your savings, investments, and insurance coverages to optimize tax benefits. It’s a time to reflect on the year gone by, assess whether your financial plans are on track, and take timely action to protect both your wealth and well-being. Thoughtful tax planning at this stage can not only reduce your tax burden but also pave the way for long-term financial resilience and peace of mind.

Investing in a health insurance policy is one of the most effective ways to secure your financial future while maximising tax savings. It serves the dual purpose of providing essential healthcare coverage while also offering significant tax benefits under Section 80D of the Income Tax Act. Premiums paid toward health insurance policies are tax-deductible, making them a smart financial investment.

Individuals below 60 years of age can claim deductions of up to Rs. 25,000 annually for health insurance premiums paid for themselves, their spouse, and dependent children. For senior citizens, this limit increases to Rs. 50,000, acknowledging the higher medical costs in later years. Additionally, if you pay health insurance premiums for your parents, you can claim an extra deduction of Rs. 25,000 if they are below 60 years or Rs. 50,000 if they are 60 or older.

Moreover, a deduction of up to Rs. 5,000 is available for preventive health check-ups, but this is included within the overall Rs. 25,000 or Rs. 50,000 limit, depending on age. By leveraging these benefits, individuals can optimize their tax savings while ensuring comprehensive health coverage for themselves and their families.

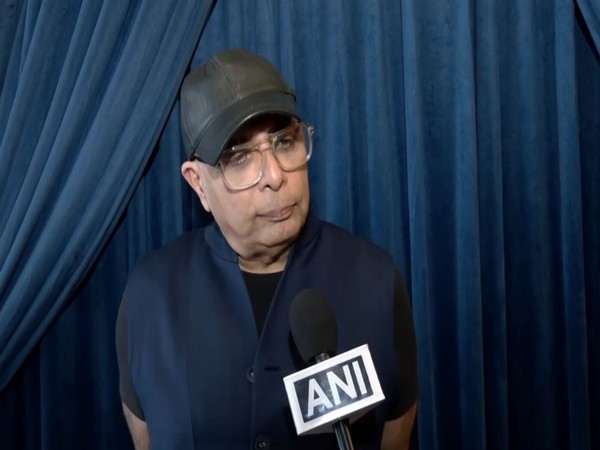

Subramanyam Brahmajosyula, Chief Product & Marketing Officer, SBI General Insurance, added, “As the financial year draws to a close, it’s the right time to take stock of your financial health and make decisions that not only offer tax advantages but also long-term security. Health insurance continues to be one of the most efficient instruments to achieve both. Under Section 80D, policyholders can avail significant tax deductions while ensuring their families are financially protected against unforeseen medical expenses. We encourage everyone to review their health insurance coverage, consider the needs of senior family members, and leverage digital platforms for instant, hassle-free policy issuance. Smart choices made today can lead to greater peace of mind tomorrow. Taxpayers can claim deductions of up to Rs. 25,000 on premiums paid for health insurance for themselves and their families, which increases to Rs. 50,000 if covering senior citizen parents. Additionally, preventive health check-ups up to Rs. 5,000 are included within this limit.”

While tax planning is best approached as a year-round activity, many taxpayers tend to evaluate their options as the financial year-end approaches. SBI General Insurance highlights that even last-minute decisions can be effective if they are well-informed. Now is the perfect time to review and renew existing health insurance policies, purchase coverage if you are uninsured or underinsured, and ensure that all family members especially aging parents are adequately covered to maximize available deductions. Additionally, opting for digital purchase options enables instant issuance and seamless documentation.

SBI General Health Insurance offers affordable, flexible plans tailored to diverse healthcare needs. With extensive coverage, including hospitalization, OPD consultations, maternity benefits, and critical illness, policyholders enjoy strong financial security.

SBI General Insurance, one of the fastest-growing private general insurance firms, backed by the robust support of SBI upholds a legacy of trust and security. We position ourselves as India’s most trusted general insurer amidst a dynamic landscape. Since our establishment in 2009, our expansion has been substantial, growing from 17 branches in 2011 to a nationwide presence of over 144 branches. In FY 2023-24, SBI General Insurance achieved significant growth, with a notable 17% increase in Gross Written Premium (GWP), reaching INR 12,731 crores.

The company received numerous prestigious accolades, showcasing its excellence across various domains. Key honors include being named the winner in the Large General Insurance category at the Mint BFSI Summit & Awards, the 3rd InsureNext Awards 2024 for Best Claims Settlement, and India’s Best General Insurer of the Year at the 7th Insurance Conclave Awards. At the India Insurance Summit & Awards 2024, the company secured titles for General Insurance Company of the Year and Leading Implementer of Analytics Technology in Insurance. Additionally, it was honored as the Best BFSI Brand at the ET NOW Best BFSI Brands Conclave 2024 and included in BW BusinessWorld’s India’s Most Respected Companies. Certified as a Great Place to Work in 2024, the company also excelled at the ETBFSI Exceller Awards 2024 with recognition for Best Claims Management in Insurance and Best CSR Campaign of the Year, further highlighting its commitment to social responsibility and innovation.

With a team of 8,000+ employees and our multi-distribution model covering Bancassurance, Agency, Broking, Retail Direct Channels, and Digital collaborations, we are committed to providing both Suraksha and Bharosa to all our consumers. Leveraging a vast network of over 22,518+ that includes, SBI branches, agents, financial alliances, OEMs, and digital partners, we extend our services to even the most remote areas of India. Our offerings cater to Retail, Corporate, SME and Rural segments, and our diverse product portfolio ensures accessibility through both digital and physical channels.

For more details: www.sbigeneral.in.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages