New Delhi [India], July 17 (ANI): India is well positioned to be a driver of greater wealth, says a global wealth report by Boston Consulting Group (BCG). In 2023, India has generated roughly USD 590 billion in new financial wealth, marking its largest increase in the history. India will add about USD 730 billion annually to the overall growth of the region through 2028.

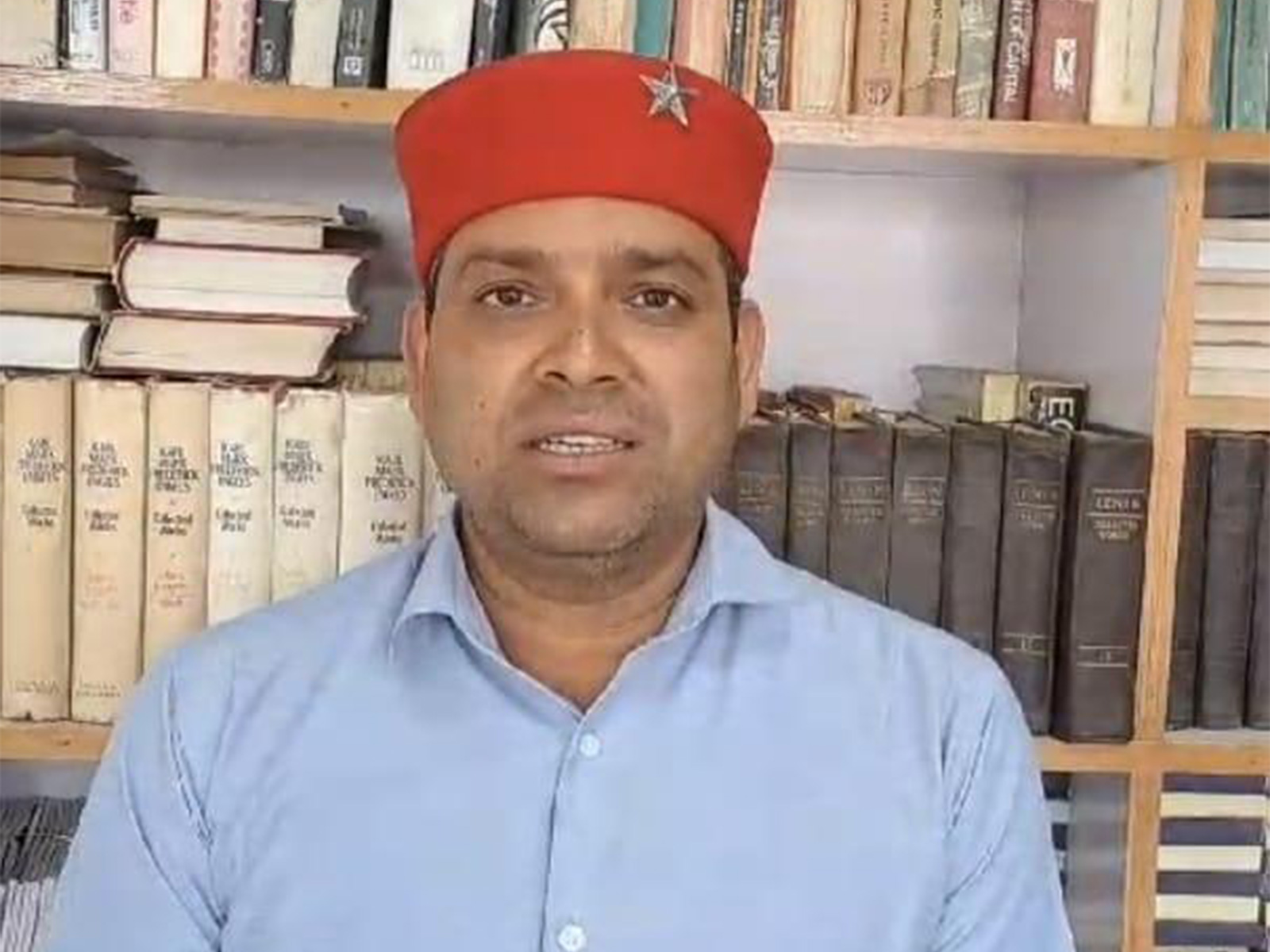

The report says China and India are positioned to drive global wealth creation, “Notably, China and India are positioned to drive wealth creation, having collectively generated USD 588 billion in financial wealth in 2023. India is expected to add about USD 730 billion annually to the overall growth by 2028,” said Yashraj Erande, India Leader Financial Services, BCG.

Financial wealth in the Asia-Pacific region grew by only 5.1 per cent in 2023, predominantly due to a slowdown in wealth creation in China. However, the report anticipates a significant increase through 2028, with the Asian region likely to contribute nearly 30 per cent of new financial wealth by 2028.

The report also observed that global net wealth registered a growth of 4.3 per cent in 2023, following a decline of 4 per cent in 2022. Much of this growth was due to a rebound in the financial market, as financial wealth, a subset of global net wealth, rose by almost 7 per cent after a 4 per cent decline in 2022.

Looking ahead, the report estimates that USD 92 trillion of financial wealth will be created over the next five years. It also noted that Generative AI (GenAI) will play a crucial role in the digital transformation of wealth managers, with use cases along the entire value chain.

“The financial wealth market has seen an uptick in the last year since its slump in 2022. The trajectory has been fairly well but not as good as it was between 2014-2021. For the wealth creation market to go back to its previous era the condition should continue to be favourable” added Yashraj Erande, India Leader Financial Services, BCG.

The report also highlighted that financial wealth in North America and Western Europe bounced back in 2023. Supported by strong equity markets, North America was among the fastest-growing regions, accounting for over 50 per cent of all new financial wealth in 2023. The recovery was not as strong in Western Europe, where financial wealth rose by 4.4 percent.

“Wealth creation resumed in 2023–but even so, wealth managers cannot afford to stand still. To capitalize on growing global wealth, industry players, among others, will need to set a clear digital transformation strategy and leverage GenAI to manage costs and improve client experience,” said Michael Kahlich, a managing director and partner at BCG and a co-author of the report.

The report stated that the most remarkable growth dynamics emerged in the United Arab Emirates (UAE). The UAE is currently the world’s seventh-largest booking centre and is expected to surpass the Channel Islands and the Isle of Man as the sixth-largest by 2028.

Hong Kong’s anticipated rise to become the top global financial hub was stalled by a temporary but significant slowdown in Chinese inflow. Singapore now appears to be in a position to challenge Hong Kong’s rise over the long term.

Switzerland remains the largest booking centre worldwide, growing in line with its historical average of 4.8 per cent and gaining the most wealth in absolute dollar terms.

However, Switzerland and other European cross-border booking centres, including the UK and Luxembourg, are growing at a slower pace than Singapore, the UAE, and the US. This shift is occurring mostly because of a stronger demand for geographic diversification, reflecting a continued surge in wealth generation in Middle Eastern and Asian markets. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages