VMPL

New Delhi [India], October 28: When it comes to building wealth and saving taxes, investors often explore multiple options that offer both stability and long-term growth. Two such investment tools, ELSS Mutual Fund and Exchange-Traded Fund (ETF), can play a key role in your overall financial strategy.

While an ELSS Mutual Fund helps you reduce your tax liability under Section 80C, ETFs are known for their diversification and liquidity benefits. Combining both can help you strike the perfect balance between tax planning and portfolio growth.

Leading financial institutions, including ICICI Bank, offer access to both mutual funds and ETFs through seamless digital investment platforms. Let’s understand how to use these instruments together for smarter investing.

Understanding the Basics

What Is an ELSS Mutual Fund?

An ELSS Mutual Fund (Equity Linked Savings Scheme) is a type of equity mutual fund that primarily invests in shares of listed companies. The key feature of ELSS is its tax-saving benefit under Section 80C of the Income Tax Act, allowing investors to claim a deduction of up to ₹1.5 lakh in a financial year under the Old Tax regime.

Key features of ELSS Mutual Funds:

* Lock-in period: Minimum of 3 years (shortest among all 80C instruments)

* Returns: Market-linked; potential for higher long-term growth

* Tax benefit: Eligible for deduction under Section 80C under the Old Tax regime

* Risk: Moderate to high, depending on market volatility

ELSS Mutual Funds are ideal for individuals seeking dual benefits, wealth creation and tax savings.

ETF Meaning: What Are Exchange-Traded Funds?

Before combining both products, it’s important to understand ETF meaning clearly.

An Exchange-Traded Fund (ETF) is an investment fund that tracks an index, commodity, or a basket of securities. It is listed on stock exchanges and can be bought or sold like shares throughout the trading day.

Key features of ETFs:

* Diversification: Tracks indices like Nifty 50 or Sensex, spreading risk across multiple sectors

* Liquidity: Traded on the stock exchange, allowing real-time buying and selling

* Low cost: Generally have lower expense ratios than traditional mutual funds

* Transparency: Holdings are disclosed regularly, ensuring visibility for investors

ETFs are suitable for investors looking for passive, cost-efficient exposure to equity markets.

Why Combine ELSS and ETFs?

While an ELSS Mutual Fund focuses on tax savings and long-term growth, ETFs enhance liquidity and diversification. Combining the two helps balance risk and optimise returns.

Here’s why this combination works well:

1. Balanced Portfolio Strategy

ELSS funds focus on active fund management, aiming to outperform the market, whereas ETFs are passively managed, mirroring the performance of an index. By combining both, you create a balanced approach, capturing market growth through ETFs while seeking alpha returns through ELSS.

2. Tax Efficiency

Investments in ELSS Mutual Funds qualify for tax deductions under Section 80C, whereas ETFs (especially equity ETFs) are subject to capital gains tax similar to stocks. The tax advantage of ELSS offsets some of the tax liability you might incur on ETF gains.

3. Diversification and Flexibility

ETFs provide instant diversification across multiple sectors and stocks. ELSS funds, being actively managed, offer an additional layer of research-driven selection. This blend ensures your portfolio isn’t dependent on one market segment or management style.

4. Liquidity Meets Long-Term Growth

ELSS has a lock-in of 3 years, ensuring disciplined investing. On the other hand, ETFs offer instant liquidity, allowing you to rebalance or exit positions when needed. Combining both ensures your investments are accessible yet growth-oriented.

How to Combine ELSS and ETFs in Your Portfolio?

Here’s a step-by-step guide to using both investments effectively:

Step 1: Define Your Investment Goals

Start by identifying your objectives, tax savings, capital appreciation, or long-term wealth creation. ELSS caters to tax planning and long-term growth, while ETFs support flexible investing and liquidity needs.

For example:

* If your primary goal is tax reduction → allocate more to ELSS.

* If your goal is steady portfolio growth → maintain a larger ETF allocation.

Step 2: Allocate Investments Wisely

A balanced allocation between the two depends on your risk tolerance and investment horizon.

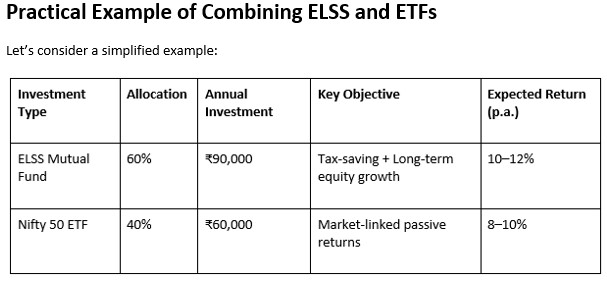

Suggested allocation model (for moderate-risk investors):

* 60% ELSS Mutual Funds: for tax savings and equity exposure

* 40% ETFs: for diversification, liquidity, and low-cost returns

Aggressive investors can reverse this ratio, giving ETFs a higher share for market-linked growth.

Step 3: Choose the Right Funds and Indices

When selecting an ELSS Mutual Fund, look for:

* Consistent long-term performance (5-7 years)

* Experienced fund management

* Diversified equity exposure across sectors

When selecting ETFs, consider:

* Broad-based indices (like Nifty 50 ETF or Sensex ETF)

* Sector-specific ETFs for tactical exposure (e.g., banking or IT ETFs)

* Expense ratios and tracking error

Digitally advanced financial institutions, such as ICICI Bank, offer platforms where you can compare, evaluate, and invest in both ELSS and ETFs easily.

Step 4: Use SIPs for ELSS and Lump Sum for ETFs

To maximise returns and reduce volatility, invest in ELSS funds through a Systematic Investment Plan (SIP). This approach averages out the cost over time and ensures consistent contributions throughout the year.

For ETFs, you can consider periodic lump-sum investments when the market dips, enabling cost-efficient accumulation of units.

Step 5: Review and Rebalance Annually

Market conditions change, and so should your portfolio allocation. Review your ELSS and ETF performance at least once a year. If one asset class significantly outperforms the other, rebalance your portfolio to maintain your original allocation.

Total annual investment: ₹1.5 lakh

Here, ₹90,000 invested in ELSS provides tax benefits under Section 80C, while ₹60,000 in ETFs helps achieve liquidity and cost efficiency. Over time, this balanced strategy compounds wealth while optimising tax savings.

Key Benefits of Combining ELSS and ETFs

* Tax Optimisation: ELSS reduces taxable income while ETFs offer capital appreciation.

* Diversification: Exposure to both active (ELSS) and passive (ETFs) investments.

* Liquidity Control: ETFs allow flexibility, while ELSS builds long-term discipline.

* Cost Efficiency: ETFs have lower expense ratios, balancing the management cost of ELSS.

* Wealth Creation: Both contribute to compounding returns through market participation.

Things to Keep in Mind

1) Understand Lock-in Periods: ELSS investments are locked for three years, while ETFs can be sold anytime.

2) Track Performance Regularly: Review both fund types annually to ensure alignment with goals.

3) Be Tax-Aware: When redeeming ELSS after the 3-year lock-in, profits (i.e., long-term capital gains) are exempt up to ₹1.25 lakh in a financial year, but the amount above this may attract LTCG tax at 12.5% (without indexation) under the current rules.

4) Avoid Overlapping Sectors: Ensure your ELSS and ETF investments don’t replicate the same underlying sectors excessively.

Conclusion

Combining ELSS Mutual Funds and ETFs is a smart strategy for investors seeking tax efficiency and portfolio growth. ELSS helps you save under Section 80C while encouraging long-term investing, and ETFs offer diversification, liquidity, and cost-effectiveness.

By integrating both, you build a portfolio that balances discipline and flexibility, helping you grow wealth systematically while managing taxes efficiently.

Major banks providing investment facilities, such as ICICI Bank, provide investors with the tools and platforms needed to invest in ELSS and ETFs conveniently, track performance, and make informed financial decisions.

With careful planning and periodic reviews, this combination can serve as a powerful foundation for your investment journey, one that not only helps you save taxes today but also builds wealth for tomorrow.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages