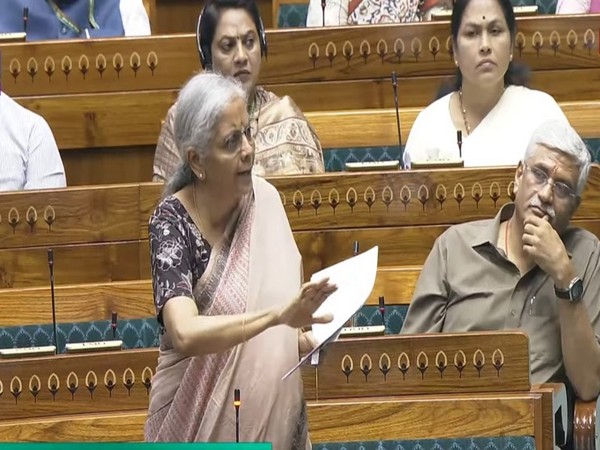

New Delhi [India] August 6 (ANI): Finance Minister Nirmala Sitharaman has proposed an amendment in the Finance Bill to give big relief on capital gains tax in property transactions.

The proposed amendment implies that taxpayers on property transactions can avail either a lower tax of 12.5 per cent without indexation or a higher rate of 20 per cent with indexation, if the property is acquired before July 23, 2024, the day the union budget was presented in the Lok Sabha.

The taxpayers can compute taxes under both schemes and will have a choice to pay tax under the scheme in which it is lower.

July 23, 2024, is now set as the cut-off date for the calculation of the capital gains versus the earlier cut-off of 2001 that had caused a lot of concern over its impact on long-time owners of property assets.

“Implications of this will be that long-term capital gain tax on the transfer of land and building acquired before 23rd July,2024 will be lower of tax computed under new law i.e 12.5 per cent without indexation and the tax computed under old law I.e @20 per cent after indexation,” tax expert and Charted Accountant Ved Jain said.

In the Finance Bill, Sitharaman had proposed a flat long-term capital gains tax of 12.5 per cent with no indexation benefits. Before it, property transactions used to be taxed at 20 per cent with indexation benefit.

Now with the proposed amendments, taxpayers will have a choice like they have in paying income tax under the old structure with deductions or under the new tax structure without deductions.

Ved Jain added that the grandfathering proposal will benefit only individual and Hindu Undivided Family (HUF) taxpayers and not companies and Non-Resident Individuals.

“The above grandfathering is only for resident Individual and HUF only. For Non-resident individuals and company, partnership firm, LLP etc this grandfathering benefit of indexation in respect of properly acquired before 23rd July 2024 shall not be available.”

The proposed amendment will apply not only on real estate transactions but also on unlisted equity transactions, which are done before July 23, 2024. All such transactions will be taxed at 10 per cent long-term capital gains instead of the budget proposal of 12.5 per cent tax.

Aam Aadmi Party leader Raghav Chadha expressed happiness that the Finance Minister “has restored Indexation benefit for Investors on Immovable Property”.

“From the 23rd day of July 2024, the day the budget was presented, I have been unequivocally saying that the removal of Indexation would be the biggest blow to Indian investors. However, the Govt has partially restored Indexation, not fully restored. I have two more suggestions to offer in this regard which would enable a full restoration of Indexation benefit: Provide Indexation benefit on assets purchased even AFTER the 24th July, 2024 and provide Indexation benefit on ALL Asset classes, not just on immovable property,” he said in a post on X.

Dr Niranjan Hiranandani, Chairman of the Hiranandani Group and NAREDCO, applauded the Finance Minister for the amendments proposed in the Finance Bill, saying this is a beneficial move for the real estate sector.

“The government’s initiative to allow taxpayers the option to compute taxes either at 12.5 per cent without indexation or at 20 per cent with indexation on real estate transactions is a significant step forward. This relief applies to the transfer of long-term capital assets, such as land or buildings, acquired before July 23, 2024,” he said.

“By enabling taxpayers to choose the lower tax burden between the new and old schemes, the amendment is poised to drive investment and enhance sales across housing segments. We are grateful for the Finance Minister’s forward-thinking approach in implementing these beneficial measures,” he added.

The Lok Sabha has begun discussion on the Finance Bill after the Appropriation Bill for the central government’s expenditure for 2024-25 was passed by the House on Monday.

The passage of the Finance Bill by Parliament will complete the budget process. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages