Mumbai (Maharashtra) [India], June 11 (ANI): The stock market closed flat on Tuesday amid volatility. The benchmark index, Sensex, ended 33.48 points lower at 76,456.59, while the Nifty inched up by 5.65 points to close at 23,264.85.

Despite the lacklustre overall market performance, the Construction, Automobile, and Public Sector Undertaking (PSU) banks sectors were the standout performers.

Throughout the trading day, the Sensex and Nifty displayed mixed signals, with the benchmark indices maintaining steady gains during intra-day trading.

This movement was predominantly fuelled by robust performances from Larsen & Toubro (L&T) and key automobile stocks such as Tata Motors and Maruti.

The resilience in these sectors provided a cushion against the broader market volatility.

The broader market indices outshined the benchmarks, with the BSE SmallCap index advancing by 1.08 per cent and the BSE MidCap climbing by 0.81 per cent.

These gains indicate strong investor confidence in smaller and mid-sized companies, even amidst an overall uncertain market environment.

Among the Nifty companies, there were 28 advancing stocks and 22 declining ones at the close of the trading session.

The top gainers included Oil and Natural Gas Corporation (ONGC), Tata Motors, L&T, Adani Ports, and Maruti Suzuki.

These companies experienced robust buying interest, driven by positive sectoral developments and optimistic market sentiment.

Conversely, significant declines were observed in stocks such as Kotak Mahindra Bank, Divi’s Laboratories, ITC, Reliance Industries, and Dr. Reddy’s Laboratories.

These stocks faced selling pressure due to various factors, including sector-specific headwinds and profit booking by investors.

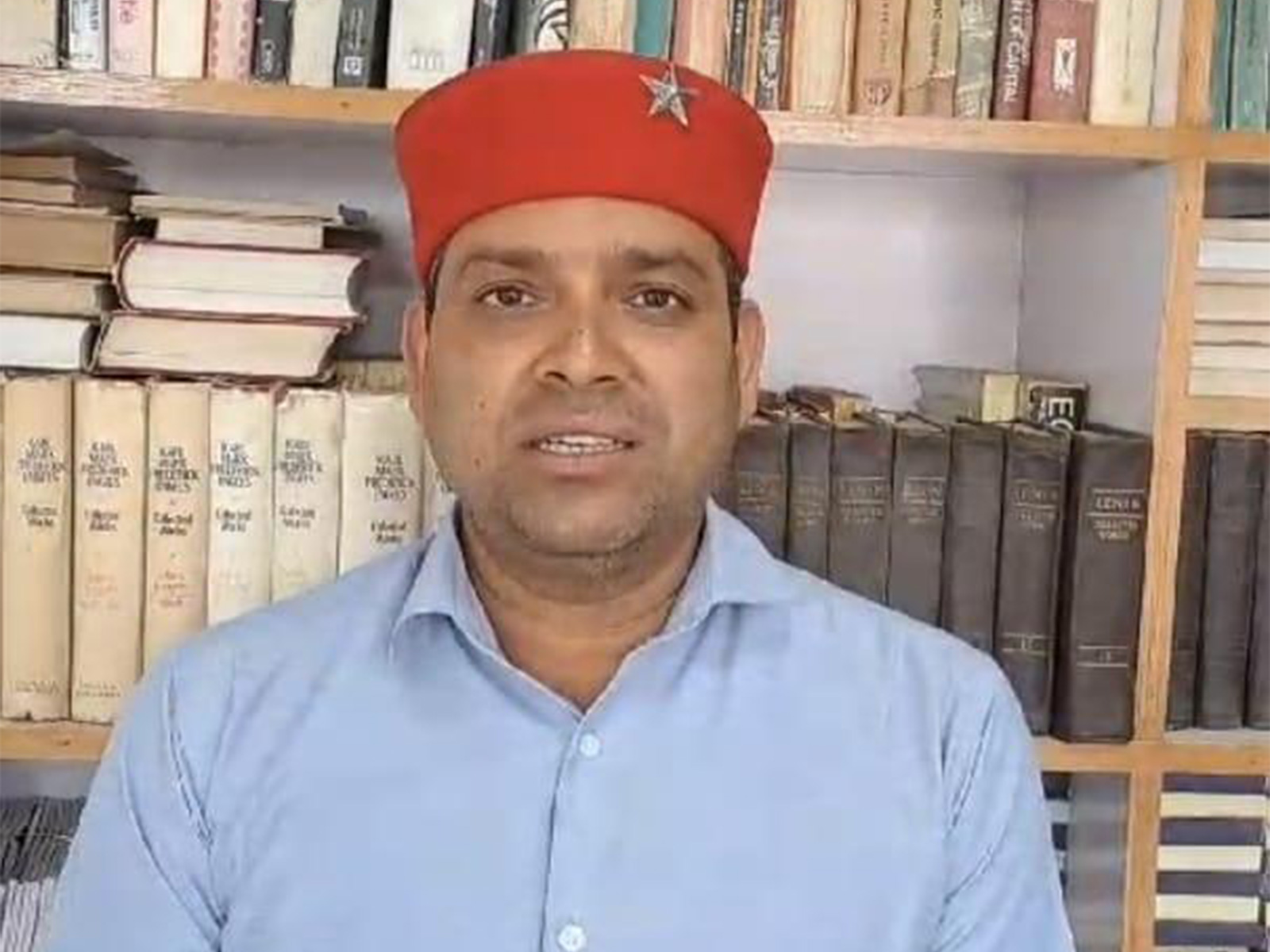

Varun Aggarwal, founder and managing director, Profit Idea, said, “Asian markets painted a more somber picture, with the MSCI’s broadest index of Asia-Pacific shares outside Japan dipping by 0.5 per cent. Chinese blue-chip stocks, in particular, fell by 1.2 per cent, leading to a decline in the yuan to a seven-month low. This drop underscores growing concerns over China’s economic outlook and its impact on regional markets.”

Investors are closely watching the upcoming U.S. consumer price inflation data and the Federal Reserve’s policy decision scheduled for Wednesday.

Aggarwal said, “The anticipation of these key economic indicators has kept market participants on edge, with rate futures indicating a reduced expectation of 38 basis points of Federal Reserve easing for the year, down from the previous expectation of 50 basis points.”

Gold prices remained steady, hovering above one-month lows, as investors awaited further economic data that could influence market sentiment.

Meanwhile, oil prices held firm ahead of key supply and demand data releases, with Brent crude futures trading at USD 81.62 a barrel.

Tuesday’s market session in India was marked by sector-specific performances and broader market resilience amid global economic uncertainties.

As investors gear up for critical economic data releases and policy decisions, market volatility is likely to persist in the coming days. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages